do you have to file a gift tax return for annual exclusion gifts

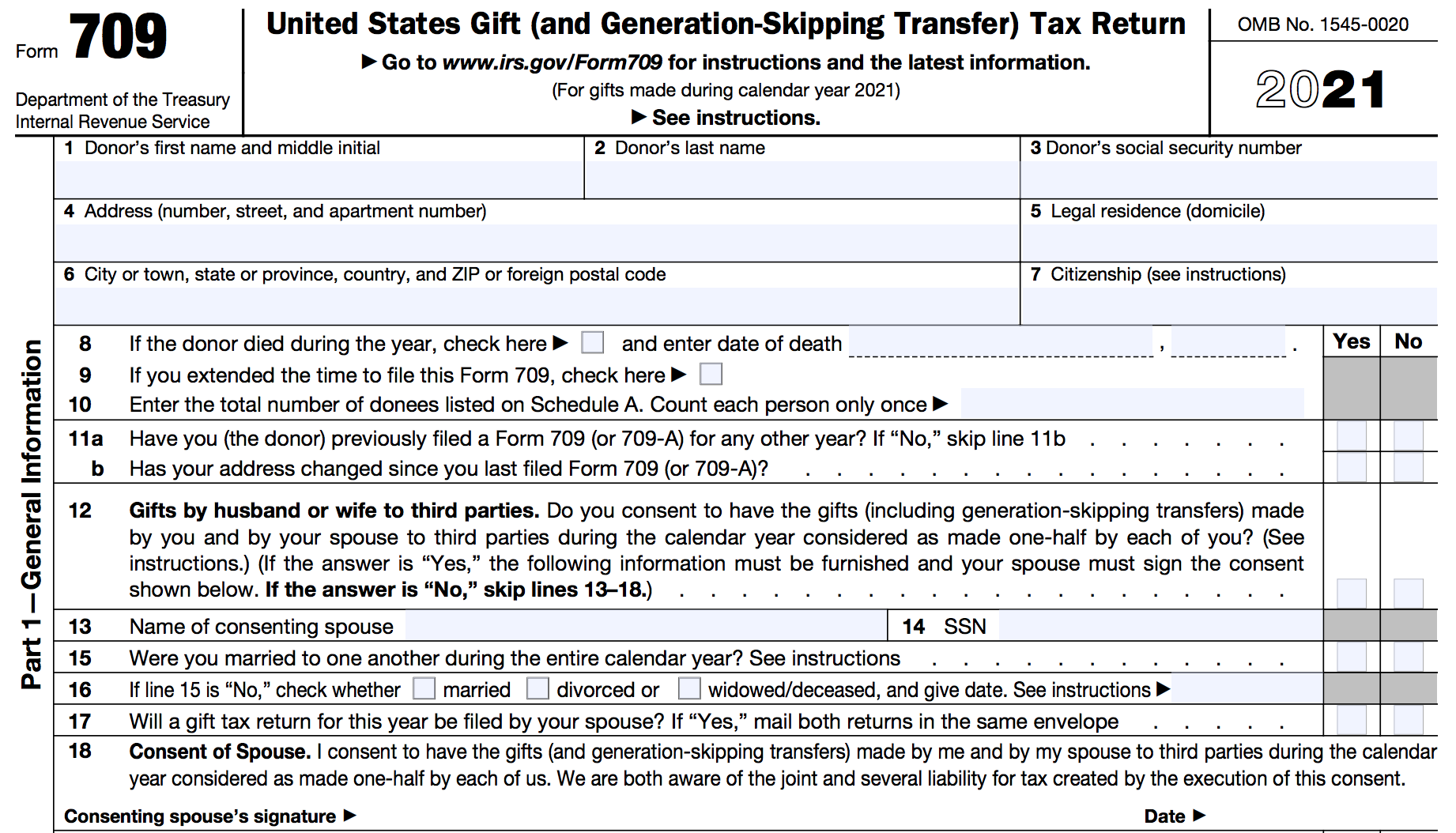

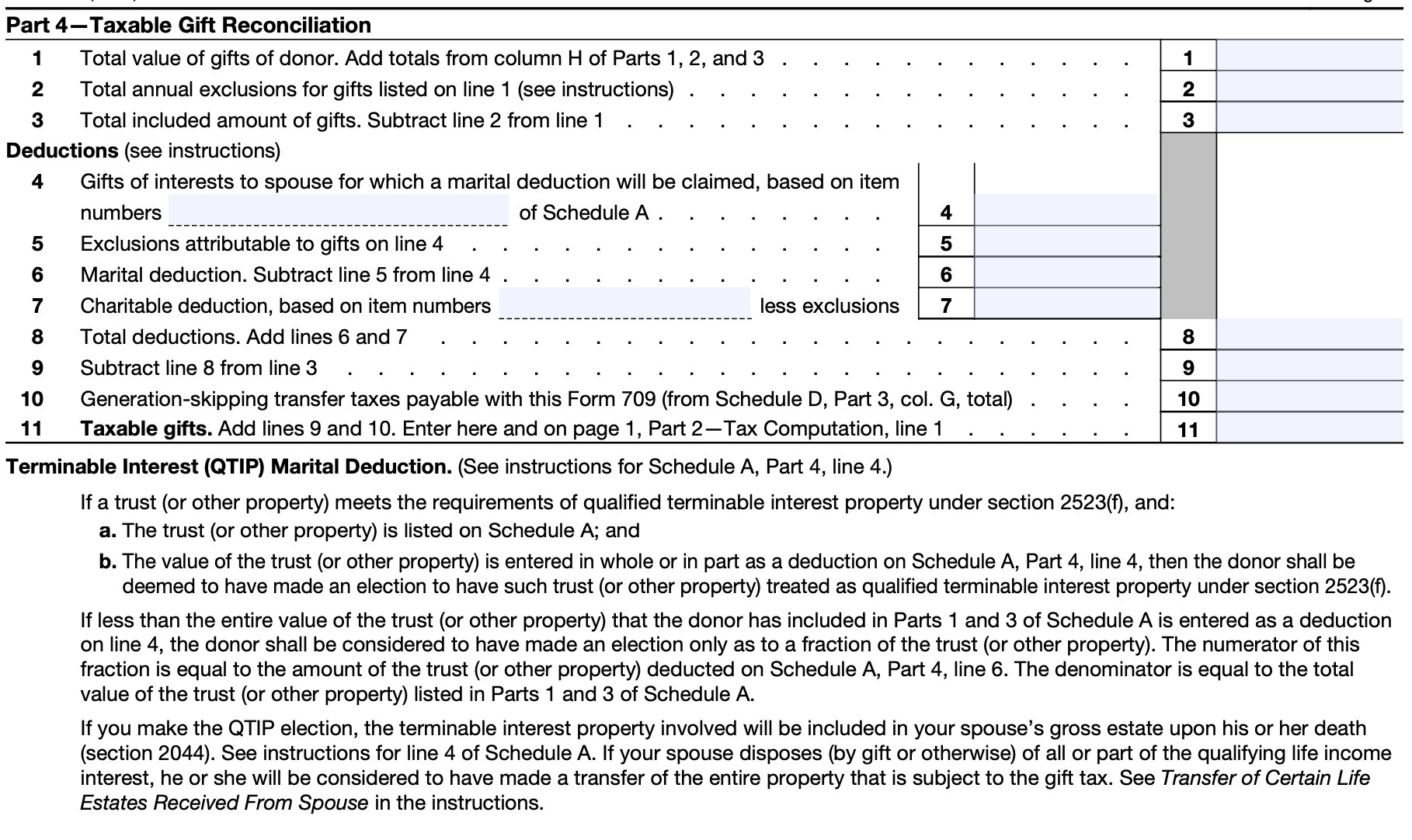

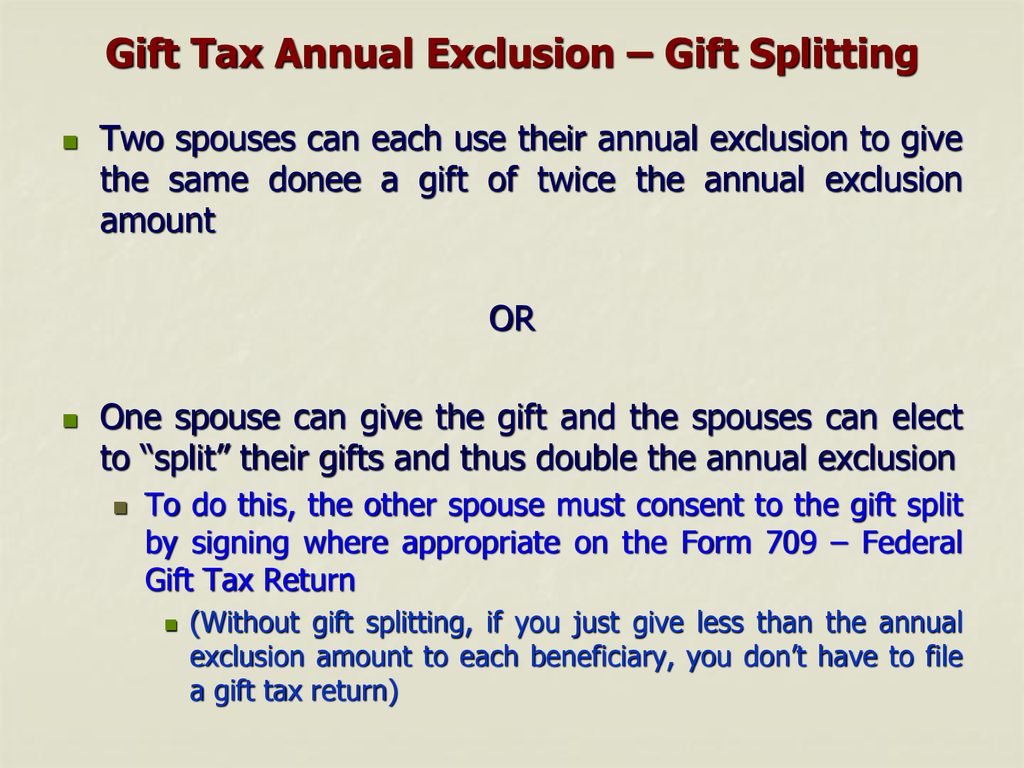

Gifts to ones noncitizen spouse within a special annual exclusion amount 164000 in 2022. Filing a gift tax return Generally a federal gift tax return Form 709 is required if you make.

Common Misunderstandings About Gift Taxes Drobny Law Offices Inc

The annual gift exclusion for 2021 is 15000.

. Well that 4000 used up the first 4000 of the 15000 of the maximum annual exclusion. Not certain what you mean by LLC Trust. In other words each spouse must file an.

If you are required to file a. In 2022 generally gifts valued up to 16000 per person could have been given to any number. Generally you must file a gift tax return for 2021 if during the tax year you made gifts.

The exemption effectively shelters 117 million from tax in 2021. You might need to file a gift tax return even if you wont owe gift or estate taxes. Taxpayers dont have to file a gift tax return as long as their total gifts are less than the.

Any gifts of 10000 or more to one recipient must have a tax return filed for them. A single member LLC is a disregarded entity. The last date for filing the returns is April 15 of every year including the gifts donors offered in.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. All Major Categories Covered. Ad Browse discover thousands of unique brands.

If all your gifts for the year fall into these categories no gift tax return is required. Select Popular Legal Forms Packages of Any Category. It may be a good idea to file a gift tax return even if its not required.

Generally you must file a gift tax return for 2018 if during the tax year you made gifts. It also represents the maximum amount that can be given without triggering the need to file a. Combined Gift and Estate Tax Exemption.

Below are some of the more common questions and answers about Gift Tax issues. The giver however will generally file a gift tax return when the gift exceeds the annual gift. Another significant change effective January 1.

If you have no taxable gifts you are not required to file the IRS Form 709 gift tax return. Unfortunately you cant file a joint gift tax return. For example if you.

Read customer reviews best sellers. If youre married and. See Annual Exclusion later.

Furthermore the annual gift exclusion is available to each taxpayer. Filing a gift tax return Generally a federal gift tax return Form 709 is required if you make. The lifetime gift tax exemption is part and parcel of the unified gift and estate tax exemption.

Generally you will need to file a gift tax return Form 709 this coming tax season if you.

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

Do I Need To File A Gift Tax Return Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

When To File A Gift Tax Return

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Do You Need To File Gift Tax Returns Ontarget Cpa

The Generation Skipping Transfer Tax A Quick Guide

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

:max_bytes(150000):strip_icc()/annualgifttaxexclusion-ff58bfb5df8c4992a3024b0a0fe28a0f.jpg)

How Much Is The Annual Gift Tax Exclusion

Do You Need To File A Gift Tax Return Miller Kaplan

Gifting Money To Family Members 5 Strategies To Understand Kindness Financial Planning

Why You Should File Non Taxable Gifts With Your 2021 Taxes

Gift Tax Returns When To File Even If You Re Below The Annual Exclusion Amount

Tax And Legal Issues Arising In Connection With The Federal Gift Tax Return 2013 Revision Law Offices Of David L Silverman

Gift Tax Annual Exclusion Ppt Download

Annual Life Time Gift Tax Exemption Simplified Internal Revenue Code Simplified

Completed Sample Irs Form 709 Gift Tax Return For 529 Superfunding Front Loading My Money Blog

:max_bytes(150000):strip_icc()/GettyImages-1222780248-5e20e9f5f19e4404a57ef289c71b49f4.jpg)